Choosing the right partner for your office portfolio

What to consider if you have vacant properties in multiple locations

Landlords with long term voids often enquire as to whether or not their buildings are suitable for a flexible working product. The initial research is conducted on the location, demand, desk rates and competitors in their market place. This is all vital, however it is then essential to screen the right partners, if considering a profit share or management agreement. Not all potential partners, despite their interests, have the best fit skills, expertise and product DNA for all locations.

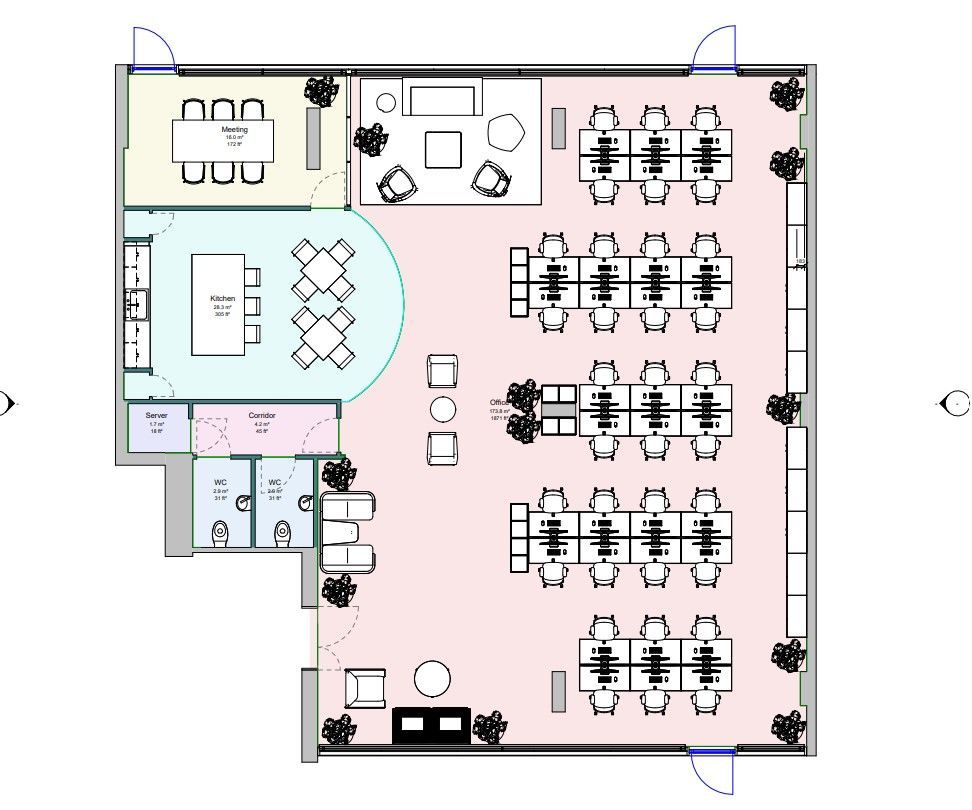

The type of buildings within your portfolio, their location and history will guide the types fitout/design and ultimately then a short list of potential partners.

Common building types::

Traditional Business Centre- Modern in design, function, modest density, smaller breakout areas, small/medium level of amenities, contemporary design, mainstream appeal, c.7,000-30,000sqft medium priced. Provider Examples Regus (IWG), Orega, Clockwise, BE offices or Boutique.

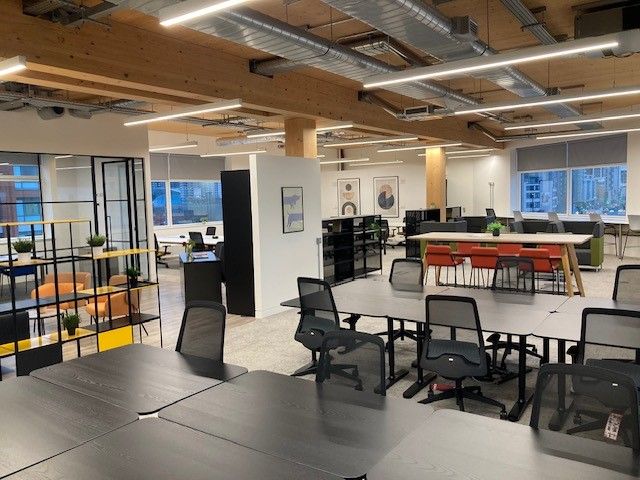

Modern Coworking - Higher density offices, expansive breakout areas, in busy communities, good range of amenities, vibrant design, Broad clientele, c.3,000-25,000sqft medium to high priced. Provider Examples WeWork, Work.life or Runway East

Design Led - Strong identity, high density offices, prominent location, unique amenities, architecturally strong, quality breakout areas, sustainable, Quality Tech, Niche Clientele, c.15,000 - 25,000sqft High priced. Provider Examples Uncommon or TOG

Innovation Hubs - (Niche) High and Low Density offerings, big conference areas, shared work studios, welling areas, breakout spaces, share tech facilities, over c.25,000sqft, Varied price ranges. Provider Examples Plus X or HERE.

Consumers of flex spaces are considering a huge variety of variables when selecting a new office space. These variables will form part of a providers 'key differentials' too and reflect in their overall product DNA.

So what are the variables influencing the occupier when selecting a flex space?

Client Variables:

Building - Types of Amenities, Location, Demographics, Accessibility, Price, Green Rating, Design & Style, Technology...

Human Factors - Productivity, Quality of Environment, Wellbeing, Talent Attraction, Employee requirements...

Economy: Interest Rates, Inflation Factors, Wage Factors, Cost of Office, Investment, Recessions Risk, Growth...

Therefore, its important to understand what type of building you will create, who it's primarily being marketed too and the level of fitout and investment required.

Office space is no longer just a functional work environment, it must add specific value to its occupiers and appeal to rapidly changing working trends. If you're a Landlord, get involved with your building and location, take time to understand what your future occupiers are looking for and evolve.